or Call for Consultation

+902365472190

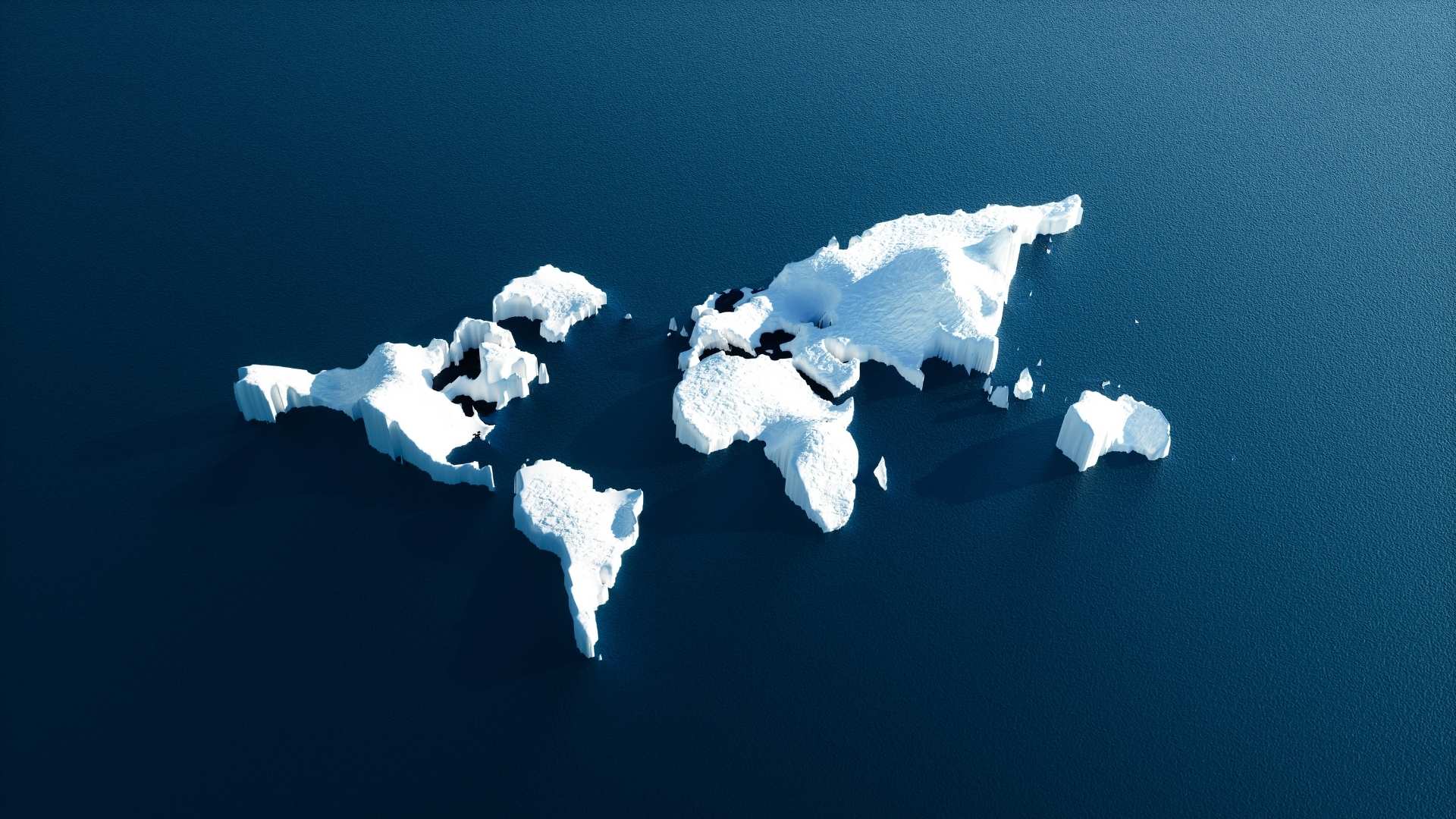

In the investment realm, risk and returns are intrinsically linked, forming the cornerstone of decision-making. Specifically, in managed farmland investments, where variables like crop yield and land value fluctuate, understanding this relationship is crucial. Potential risks include: Late Tree Development: Delays in crop maturity can affect yield timelines and profitability. Market risk is a universal factor that affects all investments within a particular market or asset class. Also known as unsystematic risk, this type of risk is unique to a specific investment or sector. Investors often trade between risk and potential returns. Investors employ various strategies to manage and mitigate risks. Insurance can play a role in mitigating certain investment risks. With our team concertedly, we have developed a unique investment model that helps reduce both systematic and unsystematic risks. At Invest4Land, risk mitigation is at the core of our investment philosophy. We’ve meticulously crafted an investment model shielding investors and farmland projects from potential risks. Our approach encompasses strategic decisions that encompass agricultural real estate and crop selection. Here’s how we proactively reduce risk: We understand that real estate and agriculture investments share the characteristics of long-term stability. Resilience in Essential Food Crops: Our commitment to essential crops is strategic. Strategic Crop Selection: Our emphasis on walnuts and almonds is deliberate. Investing in almonds and walnuts leverages the inherent attributes of these dry fruits, creating a resilient investment avenue that defies the constraints of perishability associated with many other food products. By choosing these commodities, you align with an investment that combines stability, export potential, and durability. Investing in Turkish farmlands, coupled with TARSIM’s agricultural insurance framework, provides a strategic advantage. This combination enables you to tap into a resilient investment opportunity while benefiting from a well-structured risk mitigation strategy. Navigating Risk and Safeguarding Your Investment: A Comprehensive Outlook

Climate Change: Shifts in weather patterns can alter land usability and crop viability.

Water Issues: Availability and rights can significantly impact farming operations.

Natural Factors: Soil fertility and pest infestations can degrade land quality.

Like any investment, farmland is susceptible to market and technical conditions that may devalue assets. Proactively managing these risks is pivotal to safeguarding your investment and maximizing its potential. Here’s a comprehensive look at the types of risks investors typically face, with strategies to mitigate each and ensure long-term sustainability.

Market Risk (Systematic Risk)

Specific Risk (Unsystematic Risk)

Risk vs. Return Trade-off

Risk Management Strategies

Insurance and Investment

At Invest4Land

Mitigating Risk: Invest4Land’s Strategic Approach

Thoughtful Agricultural Real Estate Selection

Mitigating Perishability: Almonds and Walnuts as Resilient Dry Fruit Investments

Climate and Natural Disaster Resilience: Leveraging TARSIM for Protection

Send a message